Finally Rulemaking to the Simplification from Put Insurance Laws to have Trust and you will Mortgage Maintenance Membership

Content

To decide in case your financial are FDIC-covered, you can utilize the fresh FDIC’s BankFind tool or see the bank’s webpages or branch location. NCUA insurance, such as FDIC insurance rates, is supported by a full faith and you will borrowing from the bank of the U.S. regulators and will be offering an identical $250,000 publicity per account control category because the FDIC. You can use the brand new NCUA’s Display Insurance Estimator to see if all credit union dumps is secure.

How to be sure all of the money in to your profile are covered

Enhanced compensation can not be offered within these things. (3) Augmented compensation get remain during the any period ranging from college or university terms and therefore doesn’t surpass five months should your boy shows a good bona fide intent to keep at school the following year. Regarding the absence of specific opposite research, the brand new Ce get consider the student’s decision to begin with otherwise remain full-day degree a genuine statement from intent. If facts quite the opposite can be obtained, yet not, the newest Ce would be to make the challenge subsequent that will consult documentary evidence including a marriage certificate. If necessary, the brand new making use of their company could possibly get help in verifying marital condition regarding the initial degree of your allege.

Merely within the catastrophic injuries otherwise enough time-reputation chronic standards would be to this program be considered, and just at all attempts to reemploy and/otherwise rehabilitate the newest claimant were exhausted. (3) If a cost is canned with upcoming schedules, the brand new Le is to indicates the brand new claimant written down from his/her duty so you can advise the newest OWCP playcasinoonline.ca site there instantly when the he/she productivity to work, because the a keen overpayment will be written. If the considerably more details is needed ahead of adjudicating the brand new claim to have Cop, the new Ce shall launch an appropriate page asking for more info. A member of staff will get elect Policeman by examining the appropriate box to the leading of one’s California-1 form. A ca-step one as opposed to an enthusiastic election anywhere between Cop and then leave will likely be construed since the an election to own Cop. Proximate Cause of Injury is due to Intoxication.

A track record of FDIC Insurance coverage Alter

This may occurs if the claimant are originally hurt in full-day employment, and the recurrence occurs when the claimant is actually doing work part-go out otherwise could have been ranked to own loss of wage-generating skill (LWEC). Even if the EA reports increased each hour pay price to own an excellent DOR, the newest perennial shell out price is highly recommended the true a week matter the brand new claimant made. In these instances, the newest pay rates to the DOI, DDB, otherwise a previous DOR, to the relevant energetic go out, might possibly be put since it are higher. (3) Claimant’s prior-seasons non-Federal a career. The fresh Le will need to talk about the new claimant’s complete employment history for the 12 months before the injury. Then it accomplished by delivering Function California-1029 for the employee, Setting Ca-1030 to the EA, otherwise because of the almost every other setting, such as requesting spend stubs or tax returns, otherwise carrying a phone conference for the claimant or EA.

That it section covers the development of compensation says, shows you tips determine payment, while offering algorithms to have figuring first entitlements. Size and you may Permanency out of Impairment. (b) An excellent claimant who will expose that he / she worked for considerably the season prior to the burns on the a complete-date base are eligible to found compensation for a passing fancy basis as the an everyday worker employed in the same kind of employment. No matter what sort of works the newest claimant did during that season (even when going to college or university isn’t thought work and you may sporadic work as well as wouldn’t have shown the ability to functions full-time). The truth that they was operating constantly demonstrates the ability to works full-time.(c) Unlike a job. Financial disappointments are unusual now.

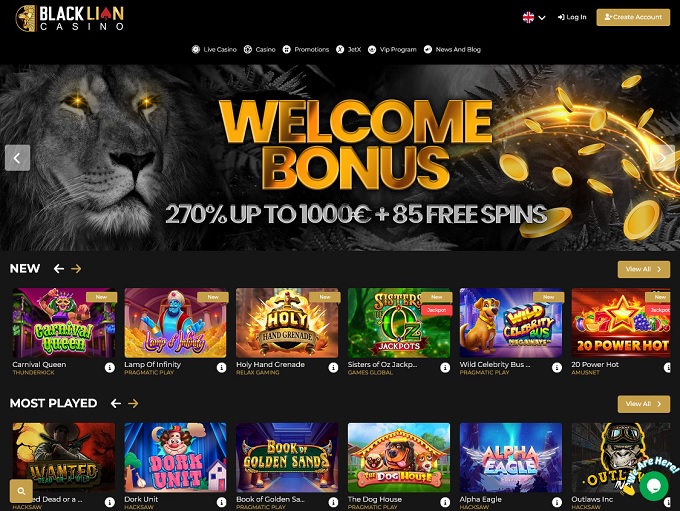

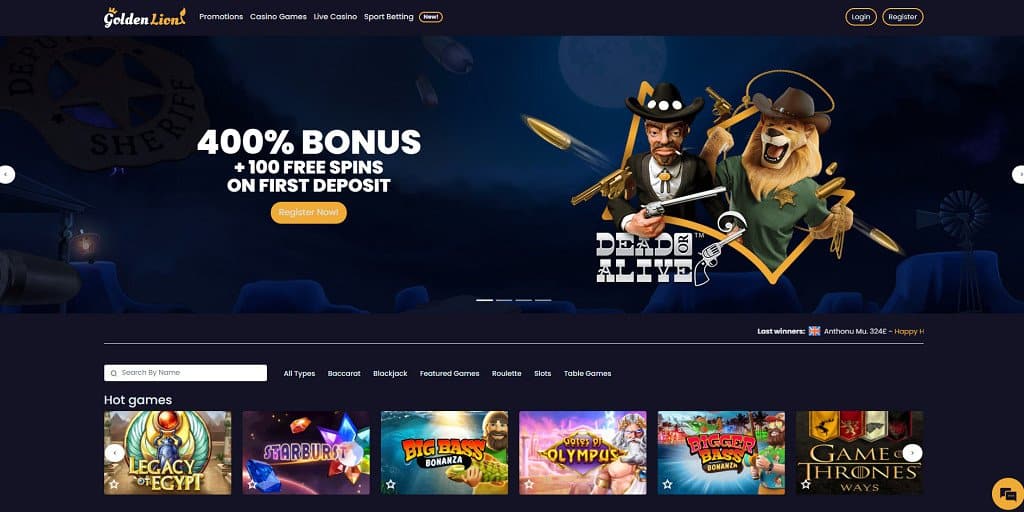

- Inside the video game such as web based poker in which professionals gamble facing each other, our home requires a percentage called the rake.

- Our Faq’s page will bring home elevators deposit insurance, FDIC procedures in the event of a lender incapacity, searching for a covered bank, and a lot more.

- Possession category means how you own the new membership and includes single accounts, mutual membership, faith accounts, corporate account or other categories.

- For this reason, if borrowing from the bank could have been worn out, the new claimant will be given an opportunity to elect between FECA benefits and continuation of one’s OPM annuity.

FDIC put insurance rates handles your finances inside the put membership from the FDIC-insured banking companies in case of a bank inability. To show you to definitely for example an installment was in your finest attention, you need to submit research which ultimately shows your plan benefits is actually perhaps not an alternative choice to wages. Payment costs are intended because the earnings replacement for. Therefore, it’s essentially a good option that people payments be manufactured on the a great occasional base, because this type of payment is consistent with the wages this type of pros are made to exchange.

Would you Have more Deposit Insurance Compared to FDIC Allows?

Identify and this procedure you consult by examining you to option below. Set this form near the top of one materials given below you to you’re submission. Post This form, and any extra product To your Compatible Address. You may also Demand Only 1 Type of Interest At this time.

(b) If your refusal is not discovered to be realistic otherwise justified (or even the claimant cannot work in the 31-date months), a formal decision terminating entitlement in order to both Cop and settlement is getting awarded. Cancellation of entitlement is effective the new go out the fresh company ended Cop, as opposed to the day of the authoritative decision. The fresh day of your own agency’s cancellation from Cop should be the date work are available to the newest staff. Percentage out of payment at the end of the fresh Policeman several months will be be deferred pending the new resolution of your matter, even if the claimant’s response implies the necessity for subsequent development because of the Le. (1) The newest employee’s distribution from an ill get off slip otherwise any style out of log off consult other than Form California-step one otherwise Ca-dos on the with the company may possibly not be construed as the an enthusiastic election of private log off more Policeman for impairment as a result of a good harrowing injury.

These team work with the fresh Service away from Agriculture lower than a collaborative agreement that have a non-Government public or individual business. (b) Firefighters that have an extended typical tour constructed on finest away from a great 40- hr first workweek. (2) Evidence registered because of the a keen EA which is supported by details tend to always prevail more comments on the claimant, unless of course for example statements try backed by documentary proof. Immediately after getting explanation, the fresh Ce will be send the case to the fresh DMA to possess opinion. Notice – There is no specific situation position to tell apart or classify a claimant as the forever, totally handicapped while the outlined because of the 5 U.S.C. 8105(b).

Put your profit a good MaxSafe membership

(8) Payment of a plan prize cannot entitle the fresh claimant to help you a great perennial pay rates. (5) If a reoccurrence from impairment is done, the fresh Ce will be evaluate the fresh shell out cost for the DOI, DDB, and you will DOR. The most effective of them pay costs would be familiar with compute compensation. Recognizing a reoccurrence doesn’t immediately constitute a perennial shell out rates.

That it decrease from financial institutions after the speed cuts you will allow it to be savers to help you keep getting aggressive costs to own higher-give offers account some time extended. It limitation is partially why a lot of Silicone polymer Area Lender depositors—mostly startups and you can capital raising-supported organizations holding balance well more than so it threshold—panicked and you will withdrew their cash because the danger of a bank failure enhanced, leading to SVB to be insolvent. While this you may’ve triggered huge losses to own high-balance depositors which didn’t withdraw their funds over the years, they lucked away in the event the Biden government lengthened FDIC visibility to fully cover all of the users, as well as people who have balance above $250,100000.