6 Niches Which Would Possibly Be Good For Online Marketing

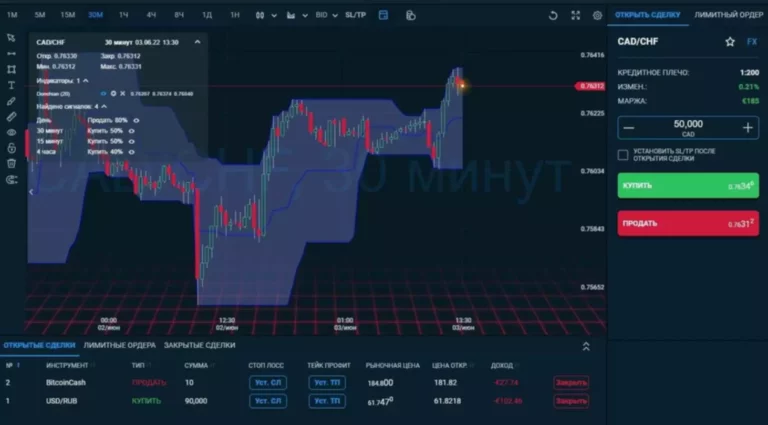

Enjoy a broad range of servicers with the objective of generating new enterprise and incremental income opportunities. With a completely branded, confidential strategy, iFOREX enables its partners to simply deliver revolutionary, leading edge trading applied sciences and options to shoppers worldwide. The Paxful Affiliate Program offers customers the prospect to earn cash by selling Paxful to their community of contacts. Bitcoin and crypto affiliate programs might help you earn passive income for years to come. Whether you run a well-liked forex affiliate software blog, news website, YouTube channel, or Twitter account, a crypto affiliate program can generate a recurring earnings stream that you could depend upon. Tailor commissions utilizing automatic tiers and personalised IB fee structures based on Volume and FTD.

Tax Advantages Obtainable To Senior Residents

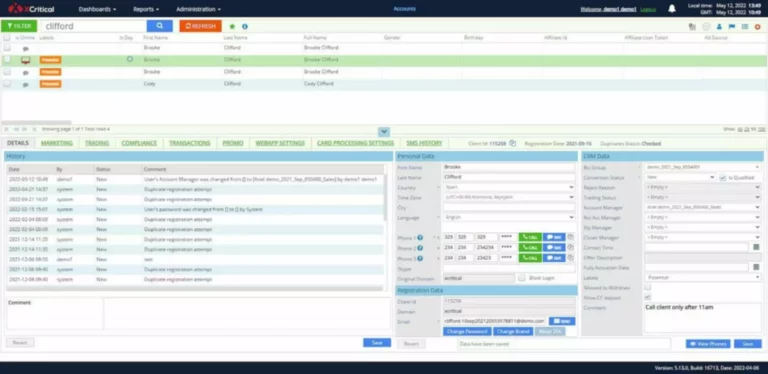

With a confirmed observe record of managing over 10,000 customer accounts, Trade Workz delivers unparalleled accuracy with speed. However, the quantity of payment commissioned by you is decided by the player’s involvement in the game. Depending on the agreed model, advertisers pay associates on a Hybrid, Revshare, or CPL foundation.

What Are The Benefits Of Crypto Investing?

They also use the affiliate monitoring software program cellxpert to easily monitor your affiliate internet marketing efforts. It’s an change platform that helps heavily traded cryptos like Bitcoin, Ethereum, and others. It was founded in 2012 to advertise decentralized currencies and create an equal world.

A Multi-award Profitable Affiliate Tracking Platform

Hybrid models combine these approaches, providing affiliates a balance of recurring and one-time earnings. Choosing the proper model depends on your advertising method and long-term goals. With the proper strategies, changing guests into loyal, high-value merchants is an achievable feat.

Can Affiliate Marketing Turn Fintech Industry On Its Head?

Affiliates promote the merchant’s products or services and earn a commission for each sale or action generated via their unique affiliate hyperlink. Affiliate system is principally one kind of selling program where one celebration refers others about second party’s business and will get rewarded (mostly financial) in return. Particularly in Forex, affiliates refer potential traders to Forex brokers, and when a dealer clicks a link or banner and registers to commerce, then one referral completes. Forex affiliate applications present a state of affairs where both the dealer and the affiliate profit.

Brokerage affiliate packages provide an opportunity for anyone to make money on promoting and Internet assets. Not many people know this, but there could be a couple of method to earn cash from cryptocurrencies. It’s straightforward to be afraid of lacking out, particularly since cryptocurrencies have started exploding on social media and search engines with varying success stories.

Notably, this excludes the 10% commission, offering associates a fair share of the trading activity. The regulated broker IFC Markets has a two-tiered affiliate system, that’s, you could get income not solely from attracting traders, but from the new partners as properly. This will enable to earn additionally 50% of the commission remuneration of your second-tier companions primarily based on the trading activity of their purchasers.

- The contents on this website have been created in order to ease the customer’s understanding of the subject matter.

- They have a staff of seasoned educators who are committed to giving their purchasers an fascinating and instructive schooling.

- As a valued affiliate associate of the Myforexeye program, you’ll be able to benefit from the advantage of earning a outstanding 15% reve- nue share for a continuous period of 24 months.

- You could be certain deposited funds are additionally protected, and the people you refer usually have a tendency to start their accounts consequently.

Get a $12 signup bonus immediately after creating an account, and every user has a novel referral hyperlink, any new user who indicators up along with your referral link will turn into a lifetime referrer. You can start sharing the URL on websites, blogs, forums and private social media or with friends around you. You’ll earn a fantastic referral bonus every time somebody indicators up or buys by way of your hyperlink. Founded in 2008, Exness is an established Forex broker with over 600,000 global users. Its associates program is one of the most in depth at present out there in the industry, with a range of tools and systems in place to support its affiliates.

It’s become the talk of the town, sweeping by way of in style web sites, blogs, and social media platforms like wildfire. You don’t have to be a part of the influencer elite or have your personal million-dollar empire to get in on the action. They have a workers of seasoned educators who’re dedicated to giving their shoppers an interesting and instructive schooling. Forexmentor has a course for everybody, from total novices to skilled traders trying to hone their abilities. This complete crypto buying and selling platform is happy with its generous bonuses and handy payment structure. Additionally, Forex Trendy additionally offers several other options that can be useful for traders.

Earn as a lot as 50% commission on the trading charges of profitable trades they refer; shall be added to your account stability instantly. AMGCrypto is one of the world’s leading mining firms and your trusted partner. This includes onboarding assistance, training periods for efficient platform use, and ongoing help channels to handle any queries or points. Training relating to How to make use of the Automated methods without Coding for Equity and Derivative (Future & Options Trading).

Visit the Affiliate Top website and sign up for the associates program by coming into your email tackle. When selecting an associates program, go for cooperating with world-class brokers with high-quality and professional consumer service. Promote Skrill, join with potential digital pockets holders and earn a lifetime revenue share. Joining the Myforexeye Affiliate Program opens doors to the world’s largest monetary market, the foreign exchange industry. As you introduce your audience to Myforexeye’s complete suite of forex companies, you simultaneously contribute to the growth of your own business.

The draw back of this is that brokers have to charge a charge, so you often pay that bit greater than you’d with personal trade. This niche includes every little thing from furniture and equipment to color and wallpaper. There is all the time a demand for residence décor products, which could be a profitable business area of interest. You also can create thrilling movies showcasing the coolest tech tendencies or write evaluations by yourself website.

Read more about https://www.xcritical.in/ here.