Если казино предлагает качественный мобильный опыт, это может привести к увеличению числа новых пользователей, которые захотят попробовать свои силы в играх. В заключение, мобильная оптимизация в онлайн-казино — это не просто тренд, а необходимость, продиктованная изменениями в поведении пользователей и технологическом прогрессе. Казино, которые игнорируют этот аспект, рискуют потерять свою конкурентоспособность и упустить возможности для роста. Таким образом, мобильная оптимизация является важным элементом стратегии любого онлайн-казино. Она влияет на все аспекты работы казино, от привлечения новых клиентов до удержания существующих. В конечном итоге, успех онлайн-казино в значительной степени зависит от его способности адаптироваться к требованиям мобильных пользователей.

- Эффективные маркетинговые стратегии могут помочь привлечь новых игроков и удержать существующих.

- Онлайн-казино, с другой стороны, предоставляют игрокам возможность играть в любое время и в любом месте, но лишают их живого взаимодействия.

- Это не значит, что вы не можете выиграть, но важно подходить к игре с реалистичными ожиданиями.

- Кроме того, аудиторы могут проверять, как казино обрабатывает транзакции, чтобы убедиться, что они безопасны и защищены от мошенничества.

- В конечном итоге, успешное онлайн-казино — это не только качественные игры, но и умение привлекать и удерживать игроков.

В онлайн-казино могут возникать различные ситуации, такие как технические сбои, проблемы с выводом средств или вопросы по бонусам. Быстрая реакция службы поддержки может предотвратить негативные последствия и сохранить лояльность игроков. Чем быстрее казино решает проблемы, тем выше вероятность, что игроки останутся довольны и продолжат играть. Кроме того, казино мгновенная поддержка клиентов способствует созданию доверительных отношений между казино и игроками. Когда игроки видят, что их проблемы решаются быстро и эффективно, они чувствуют себя более уверенно и комфортно. Это может привести к увеличению числа постоянных клиентов и положительным отзывам о казино, что, в свою очередь, может привлечь новых игроков.

Скачать приложение казино Casino – мобильная версия на смартфон

Удобный и интуитивно понятный интерфейс позволяет игрокам легко ориентироваться в игре и взаимодействовать с дилерами. Это может значительно улучшить опыт игры, особенно для тех, кто использует мобильные устройства. Скорость интернет-соединения игрока также является важным фактором, влияющим на качество стриминга. Даже если платформа предлагает высокое качество видео, игроки с медленным интернетом могут столкнуться с проблемами, такими как буферизация или низкое качество изображения.

- Без SSL-сертификата данные передаются в открытом виде, что делает их уязвимыми для атак, таких как “человек посередине” (Man-in-the-Middle).

- В конечном итоге, выбор правильного онлайн-казино с выгодной VIP-программой может стать ключевым фактором в создании положительного игрового опыта.

- Игроки должны следить за новостями, анализировать предыдущие игры и учитывать факторы, такие как травмы и форма команд.

- Например, с помощью AI можно определить, какие игры пользуются наибольшей популярностью, и соответственно адаптировать предложение.

- Поддержка друзей и семьи может сыграть важную роль в том, чтобы оставаться на правильном пути и избегать проблем с азартными играми.

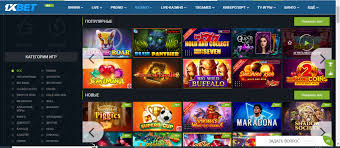

Следуя этим советам, вы сможете не только увеличить свои шансы на выигрыш, но и получить удовольствие от игры в слоты с каскадными барабанами. Это казино известно своим многообразием игр и отличной мобильной платформой. Приложение 1xBet доступно как для iOS, так и для Android, и предлагает пользователям доступ к тысячам игровых автоматов, настольных игр и живых казино. Кроме того, 1xBet предлагает щедрые бонусы для новых пользователей, что делает его еще более привлекательным. Это одно из самых известных онлайн-казино в мире, и его мобильное приложение не разочаровывает.

Бонусы клуба Casino

Если вы решили сделать перерыв, не забывайте о том, что в казино есть специальные зоны для отдыха. Кроме того, в таких зонах можно пообщаться с другими игроками и обменяться опытом. Если вы решили выпить, делайте это ответственно и не позволяйте алкоголю влиять на ваши решения.

- Стоимость цифровых валют может значительно колебаться в течение короткого времени, что может повлиять на реальную ценность получаемого кэшбэка.

- Это может включать в себя как новые игры, так и специальные акции, которые будут наиболее привлекательны для целевой аудитории.

- Например, некоторые казино внедряют механики, основанные на прогрессивных джекпотах, которые могут достигать астрономических сумм.

- Надежные платформы обычно имеют прозрачные условия и предоставляют пользователям доступ к службе поддержки.

- Определите, какие триггеры вызывают у вас желание играть, и постарайтесь избегать этих ситуаций.