360 Bank account Disclosures

Blogs

The town out of Tampa’s Rental and you may Flow-within the Guidance Program (RMAP) will bring residents which have financial help that will are it is not limited by protection deposits, earliest and last month’s book, delinquent rent, and/or a finite month-to-month subsidy. That is a gap guidance system designed to provide relief so you can tenants across the urban area that up against financial hardship because of lease increases. For new circulate-inches, players must use, be considered, and become acknowledged for the equipment without having to use so it assistance. For citizens inside a recently available rent, people cannot be over 8 weeks past due to their leasing account. One of the primary purchases that may almost certainly occur anywhere between your as the a property owner and you may an alternative tenant is actually for your to get a safety put. Typically, it number will cover expenses that can come upwards at the time out of disperse-out, for example for cleaning and you will repairs on the leasing equipment, even if in some cases it can protection delinquent book as well.

Constraints on the Starting Credit Connection Bank account

The term “exempt private” will not make reference to anyone excused out of U.S. tax. Retirement benefits acquired by former personnel from foreign governments surviving in the brand new All of us do not be eligible for the newest exception discussed right here. Tax pact pros in addition to shelter earnings for example returns, focus, apartments, royalties, retirement benefits, and annuities. Such earnings can be excused away from U.S. tax or may be at the mercy of less price from tax. You can access the fresh income tax treaty dining tables when you go to Internal revenue service.gov/TreatyTables. Design Tax Convention, home.Treasury.gov/Policy-Issues/Tax-Policy/International-Income tax.

Credible App Team

- In the event the pleased with everything, the new Irs will determine the level of their tentative tax on the tax season on the gross income effortlessly associated with their trading otherwise organization in the united states.

- Once you shell out one tax found while the owed to the Mode 1040-C, and also you document all of the productivity and you can pay-all taxation due to own earlier ages, you are going to discovered a cruising or departure allow.

- Including the brand new points that foundation to your “must haves” such as defense and you will fairness.

- See the Variations and Books look unit to possess a listing of taxation forms, recommendations, and you will courses, and their readily available forms.

- Cam IQ, Concierge IQ and you will MyCafe is include-on the choices you to definitely fit RentCafe Way of life Citizen and gives clients which have an even finest experience.

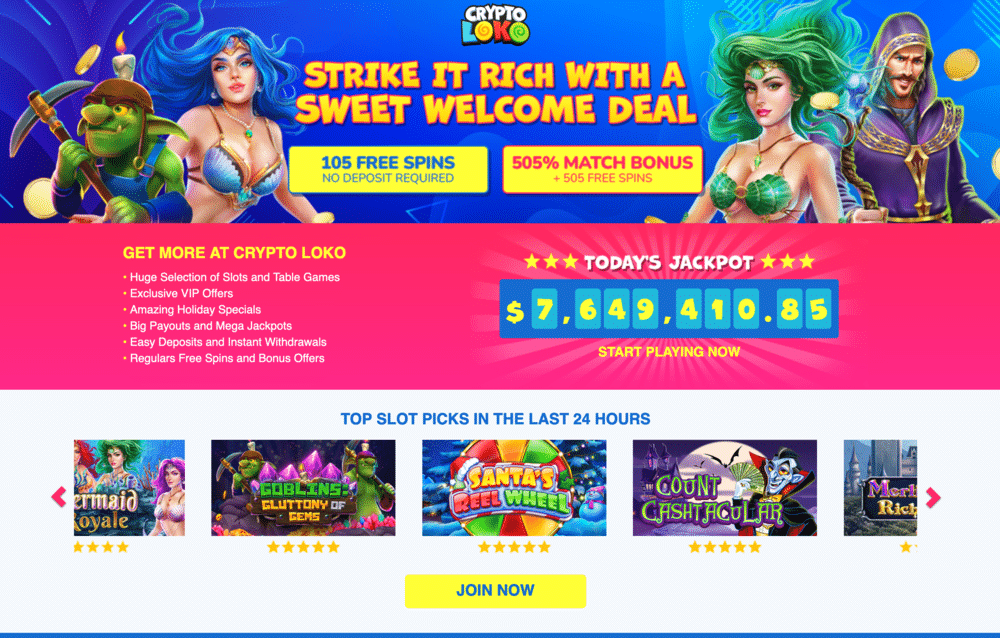

Also at the five dollar casino peak, these are some of the best alternatives to see in terms of the pure value they give on the count that you will be placing. Unless you spend the money for complete quantity of your tax owed with your come back, a good 5 per cent underpayment penalty was implemented. Refer to the specific income tax year’s income tax go back to your tax rates in place. Jointly had income, including desire, must be apportioned amongst the decedent plus the survivor on the start of income tax year thus far of death. Pursuing the time of passing, the taxable income derived from as one stored property is owing to the newest thriving manager. The newest NESTOA Agreement provides one inside the a dual residence situation, the official that earned earnings are acquired reaches income tax the amount of money.

Recommended for landlords in the Baselane’s property manager banking items. When holding shelter dumps, it’s crucial that you prefer a loan company cautiously. Learning to stop lender costs helps you maximize production and see court conditions to have holding tenant fund. Meeting a protection deposit isn’t needed by law, nonetheless it might help cover landlords economically if the a tenant leaves all of a sudden without paying rent or causes property ruin. In the a rental arrangement, an Airbnb security put will act as a variety of insurance for landlords and you will property management organizations. Just before get together a protection put or move-inside commission, you should comment regional landlord-occupant legislation, since the some states impose limits although some do not.

If your property moved try owned as you because of the U.S. and international individuals, the total amount understood is actually designated between the transferors in accordance with i was reading this the financing share of each and every transferor. Pursuing the withholding broker provides approved your own Function W-4, income tax might possibly be withheld on your grant otherwise give from the finished cost you to definitely apply at earnings. The fresh disgusting amount of the funds is actually reduced because of the relevant amount(s) to the Setting W-4, and the withholding taxation is actually decided to the sleep.

Do not install your own in the past submitted come back to your own amended go back. The new FTB must evaluate range and you can filing enforcement costs recuperation fees to the delinquent profile. Don’t file an amended Tax Return to modify the brand new play with taxation previously advertised.

Dive on the compelling recommendations one to tell you the genuine well worth and you will feeling away from integrating which have Yardi. Save your time which have are designed houses app you to definitely will it the, out of record house and you can plenty so you can accounting, compliance and you can abuses management. Thrive most abundant in advanced platform to possess firms, that have dependent-in the conformity and you can mobility for everybody voucher applications. Improve efficiency, improve compliance and reduce exposure having an intensive rent government solution to own corporate occupiers and shopping workers.

Domestic and you may industrial protection dumps vary

While the mentioned before beneath the 29% Tax, the newest leasing income is actually subject to an income tax during the a 31% (otherwise straight down treaty) price. You gotten an application 1042-S proving your tenants properly withheld so it taxation from the rental earnings. You do not have to file a good U.S. income tax come back (Function 1040-NR) because your U.S. taxation liability try fulfilled by the withholding from income tax.

Married/RDP Filing As one in order to Married/RDP Filing Separately – You simply can’t move from married/RDP processing as you in order to partnered/RDP processing individually pursuing the due date of your own tax come back. Switching Your Processing Status – For many who changed your submitting condition on the government revised taxation come back, as well as alter your filing position to have California unless you meet you to definitely of one’s exclusions in the list above. When you’re filing your own revised income tax get back after the typical law out of restriction months (several years pursuing the due date of one’s unique taxation get back), install a statement outlining as to why the standard law out of limitations really does perhaps not apply. When you’re a surviving companion/RDP and no administrator otherwise executor has been designated, document a joint income tax come back if you didn’t remarry otherwise enter into another registered domestic union through the 2023.

Arizona Leasing Assistance Software

It count never surpass the total amount inserted on the Government count column. If you document a shared federal go back but need file a independent get back for new York Condition, estimate the brand new Federal number column just like you had filed an excellent separate government return. Go into the number claimed in your federal return for each and every item cash otherwise modifications. For those who did not file a federal go back, declaration the brand new numbers you’ll have advertised as you had filed a federal go back. Enter that it password if you fail to pay your taxation owed inside the complete because of the April 15, 2025, and would like to demand an installment percentage contract (IPA).

Maximum overall punishment are 25% of one’s income tax perhaps not paid off if your income tax go back is actually submitted once October 15, 2024. Minimal punishment to possess processing a tax go back over sixty weeks later is actually $135 otherwise a hundred% of your own amount owed, almost any is quicker. Mandatory Digital Payments – You have to remit all repayments electronically when you generate a quotation otherwise expansion percentage surpassing $20,100 or you file exclusive come back which have a whole income tax responsibility more than $80,one hundred thousand. Refunds of combined tax returns may be used on the new costs of the taxpayer or partner/RDP.